Technology Review

Process Overview

Fermenting sugars produces ethanol. The sugars can be derived from a variety of sources. In Brazil, sugar from sugar cane is the primary feedstock for the huge Brazilian industry. In North America, the sugar is usually derived from the enzymatic hydrolysis (the conversion of starch to sugar) of starch containing crops such as corn or wheat. The enzymatic hydrolysis of starch is a cheap, simple, and effective process. This well developed process sets the baseline that other hydrolysis processes are compared against. The drawback to producing ethanol from sugar or starch is that the feedstock tends to be expensive and widely used for other applications. These costs are offset by the sale of co-products such as Distillers Dried Grains. The North American ethanol industry is spending considerable effort on finding new co-products that are higher in value and thus capable of making the ethanol from grain industry more cost competitive.

Lignocellulosic materials such as agricultural, hardwood and softwood residues are potential sources of sugars for ethanol production. The cellulose and hemi-cellulose components of these materials are essentially long, molecular chains of sugars. They are protected by lignin, which is the glue that holds all of this material together. The technological hurdles that are presented by the materials are:

- The separation of lignin from the cellulose and hemi-cellulose to make the material susceptible to hydrolysis.

- The hydrolysis of cellulose and hemi-cellulose takes place at different rates and over reaction can degrade the sugars into materials that are not suitable for ethanol production.

- The hydrolysis of these materials produces a variety of sugars. Not all of these sugars are fermentable with the standard yeast that is used in the grain ethanol industry. The pentose sugars are particularly difficult to ferment.

Agricultural residues and hardwoods are similar in that they have a lower lignin content and the hemi-cellulose produces significant amounts of pentose sugars. Softwoods have a higher lignin content, which makes the hydrolysis step more difficult, but they generally produce less pentose sugars.

The five processes reviewed in this report each take a different approach to the problems that lignocellulosic material present. As a result some are better suited to one type of material or another. The suitability of the process for the feedstock is addressed in each section. In some cases there is more than one company marketing the basic technological approach. In those cases the companies reviewed here were chosen because they have been active in the BC either promoting projects or participating in the development of the knowledge base here.

Four of the five processes involve hydrolysis, fermentation, and product recovery routes. Some of these also involve a pretreatment step. The fifth process is a chemical process rather than biological one. The processes are at different stages of development that makes comparisons between them difficult. A summary is provided in the conclusion section.

Iogen Corporation

Iogen is a Canadian company whose predecessor companies were founded in the 1970's. The company's initial research was on the steam explosion process for straw and wood to increase the digestibility of the feedstock as a source of animal feed. The impetus for the work was the skyrocketing grain costs of the early 1970's. Since that time the company has grown and expanded its research into the production of ethanol from lignocellulosics and the production and marketing of enzymes for a variety of applications. Iogen is Canada's only industrial enzyme manufacturer.

Iogen has sales between $10 and $20 million per year from its enzyme business. This private company claims to have been profitable for the past five years. It also claims to have spent $40 million developing its technology over the past 25 years. Natural Resources Canada has contributed over $6 million of the total.

There are 65 people on staff at Iogen including 20 to 30 in research and development. The key staff members have been with the company for over ten years. Iogen has owned and operated a one tonne per day fully integrated pilot plant in Ottawa since 1985. The facility includes pretreatment, hydrolysis, fermentation, distillation, and co-product recovery stages.

In November 1997 Iogen signed an agreement with Petro-Canada whereby Petro-Canada will co-fund research and development, and the construction of a plant in Ottawa to demonstrate the commercial feasibility of the technology. The plant is expected to cost between $15 and $30 million. Construction has begun at a site near the Ottawa airport. Petro-Canada will earn the exclusive rights to use the technology in Canada for plants to meet its own needs for ethanol. Petro-Canada positioned their investment as part of an evolution of their business to meet the challenges of reducing fossil fuel greenhouse gas emissions.

Iogen has alliances with F. Hoffman-LaRoche to develop enzymes for animal feeds and the National Research Council of Canada for improvement of enzyme properties with protein engineering techniques.

Technology

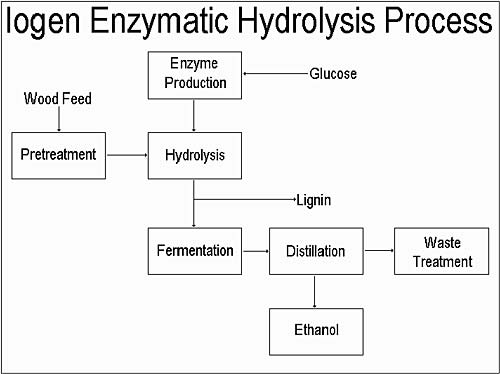

The Iogen process is an enzymatic hydrolysis process for converting lignocellulosics to ethanol. The unique aspects of the technology include the steam explosion pretreatment that was pioneered by Iogen, and the proprietary enzymes developed, manufactured, and marketed by Iogen. Iogen has patents in Canada and other countries for aspects of both the steam explosion and enzyme production. The block diagram for the Iogen process is shown in Figure 1.

Figure 1: Iogen Enzymatic Process.

The pretreatment step involves steam explosion with dilute acid conducted at elevated temperatures and pressures. The hydrolysis and fermentation steps are undertaken at ambient temperatures and pressures. Distillation is the normal ethanol industry process.

Iogen is currently building a commercial demonstration facility on a 13 acre site adjacent to the Ottawa airport. The plant is designed to process several truckloads of feedstock per day to validate the Iogen process. It will operate 24 hours per day and will allow the scale up to a 100 million litre a year plant without difficulty. Eventually, the facility will have over 20,000 sq. ft. of building space including a five story section.

The new facility will produce sugars as the primary product. Iogen will use the sugars in their enzyme manufacturing business. They were one of the first companies to be able to use glucose as the feed material for the organism producing the cellulase enzyme rather than the more expensive lactose. A small stream of product will be fermented to produce ethanol in order to validate the process. This configuration will allow Iogen to operate the facility at essentially a break even level as the sugars have a higher value to Iogen than ethanol in the marketplace. This configuration will overcome the barriers that others have faced with the high cost of operating pilot or demonstration plants.

The Iogen process is currently suitable for agricultural residues such as wheat straw and corn stover. Hardwood residues are also a suitable feedstock. A single step pretreatment process for agricultural and hardwood residues is able to produce a material that can be efficiently hydrolyzed by the enzymes. The pretreatment process is not as effective for separating the lignin of softwoods from the cellulosic material and thus the enzymes are not as effective. Much higher levels of enzymes are required and the production and capital costs are also much higher. Iogen has no plans to do further work on optimizing the pretreatment of softwoods at this time. They believe that there are sufficient feedstocks available in Canada that are suitable for their process that it is not necessary to look at softwoods now.

The feedstocks chosen by Iogen, although easy to pretreat, yield a significant quantity of pentose sugars and thus introduce the problem of fermenting these sugars to ethanol. Iogen has no proprietary technology in this area and is planning to utilize yeast licensed from one of the leading developers of the new genetically engineered yeasts that are capable of fermenting pentose sugars. Iogen has done animal feed trials of this pentose containing material but believe that fermenting the sugars to ethanol is currently the best option. There is some risk in Iogen's approach to the pentose sugars as others have found significant problems moving from the lab to larger scale fermentations. One of the process configurations that Iogen is considering is the removal of lignin prior to fermentation. This may remove some inhibitors to the yeast and make the yeast more effective but this is clearly an important step to be demonstrated before any commercial plants can be considered.

The process will produce lignin as a co-product. The relatively mild pretreatment process employed should provide a lignin that can be utilized as a starting material in other processes. In the 1980's Iogen did a substantial amount of work looking for high value markets for the lignin produced by their process. One of the applications investigated was phenol-formaldehyde resin and the work proceeded to mill trials. The work increased the understanding of the product but was not sufficiently promising to proceed to a commercial stage. One of the goals of the facility under construction is to be able to produce sufficient quantities of various lignin products so as to be able to properly investigate potential markets for the products. The fall back position is that the lignin would be utilized as a fuel to produce steam or electricity. This yields a very low price for the lignin, no more than 5 cents per kilogram.

The process will produce a large quantity of liquid waste with a high BOD and COD that must be treated and disposed of. The technology to do this is readily available but does add to the cost and energy intensity of the process. The energy intensity may become an issue if the fuel is something other than recovered lignin. If, for example, a high value market developed for lignin and natural gas provided some of the fuel there would be some discussion over how to value the energy value of co-products much as there exists a discussion on how to value Distillers Dried Grains (DDG) from grain.

Business Plan

Iogen has a well crafted business plan for the next two to three years. Their strategic objectives are:

- Build an organization that can make biomass ethanol happen.

- Lead in the development and commercial implementation of biomass ethanol.

- Build alliances to ensure a successful commercial rollout.

The company appears to be well under way in meeting its objectives. It has proven enzyme technology; it is developing manufacturing expertise around its enzyme business and with its new plant will be transferring that expertise to enzymatic hydrolysis. The commercial demonstration plant will be a leader in the industry. It will allow the company to continue with its commitment to research and development. The alliance with Petro-Canada is also a key step for the company. It brings a means to commercialization with a partner that can use the product and has the financial resources to build a series of plants across Canada. Another alliance partner that Iogen is developing is the Federal Government. It is believed that a key part of the funding for the new facility will be coming from the Federal government through an existing program, likely Technology Partnerships Canada (TPC).

Iogen is somewhat unique among the technologies reviewed in that the next steps in its development are underway. It has a facility that can be scaled up to a reasonable size and a partner in Petro-Canada that currently has the will and the resources to build commercial plants providing that the economics are reasonable.

Economics

The economics of the Iogen process have been studied and analyzed numerous times over the past fifteen years. In the mid 1980's there were three published studies on the economics of the process done by AD Little Inc., Techtrol Ltd., and Entropy Associates Inc. A report prepared for CANMET in 1989 by Entropy provides a very detailed analysis of the Iogen process. A hypothetical 1000 tonne per day of aspen feedstock plant producing 91 million litres was studied (yield of 275 litres per tonne without pentose fermentation). The plant would produce its own enzymes. The capital cost of the plant was $121 million. This included a plant to produce enzymes for the facility. The cost of the feedstock was $42 per tonne. The conclusion at the time was that the process could produce ethanol for a cost 50 cents a litre including some capital charges but no co-product credits. The report identified the potential to reduce costs to 11 cents per litre with improvements in enzyme productivity and yield, and significant co-product credit for lignin and pentose sugars.

Iogen also prepared a review of these three studies that compared them on a common assumption basis and then looked at the limits of improvement that might be reasonable based on laboratory work, comparison to similar technologies, and potential markets for co-products (Iogen 1990). Iogen agreed that costs of 50 cents per litre were reasonable with the technology that had been proven at the pilot plant level. They suggested that if leading laboratory results could be scaled up to a commercial operation then costs would be reduced to 24 cents per litre (+/- 5 cents). The upper bound on the technology was on the order of 17 (+/- 4 cents) per litre. The basis for these projections was feedstock at $40 per tonne or lower.

Iogen identified the main factors affecting the production costs and the potential improvements in each area. The first is the feedstock cost. Reducing the cost of the raw material to $20 per tonne would reduce ethanol cost by 8 cents per litre. This is not an unreasonable possibility as shown earlier in the report. The first stage of the process the pretreatment offered little potential for cost reduction, although this was for feedstocks other than softwoods.

Enzyme production and enzyme hydrolysis offered significant potential for improvement. Enzyme productivity improvements could reduce costs by 7-9 cents per litre. Enzymatic hydrolysis, the key part of the technology, offered improvements of up to 19 cents per litre from reduced enzyme requirements, faster reaction rates, increased concentrations, and hydrolysis yields.

The fermentation area costs could be improved by higher yields (pentose fermentation), productivity and concentrations and could amount to 12 cents per litre. Finally the value of lignin could be increased from solid fuel value to liquid fuel value (18 cents per kilogram) equating to 16 cents per litre. It must be recognized that some of these improvements are interdependent so the benefits in one area affect the benefits that can be realized in other areas and are not necessarily cumulative.

At the present time, Iogen is not providing public estimates of production costs for ethanol or capital costs for plants. It is known that they have made progress with the enzymes in terms of cost and productivity. For example, they switched from lactose to lower cost glucose for the feed in the enzyme manufacturing process. Improvements in hydrolysis and fermentation need to be demonstrated beyond the lab and that is one of the purposes of the demonstration plant under construction. It is not unreasonable to suggest that an ethanol production cost (without capital recovery) of 35-40 cents per litre is possible today, with feedstock at $20 per tonne and that further improvements may be possible but need to be proven in the demonstration plant. Capital costs are difficult to extrapolate from the earlier work. Costs for equipment have risen in the past 10 years but improvements in enzyme productivity and cost will have reduced the amount of equipment needed. The earlier work did have capital costs about twice that of a similar size grain to ethanol plant. That is not unreasonable given the extra processing steps and the more difficult feedstock. It must be remembered that these costs do not apply to softwoods and softwood-processing costs will be much higher given the current state of the pretreatment and hydrolysis knowledge.

One of the benefits of the new demonstration facility will be ability to further define the operating and capital costs. The scale is such that Iogen should be able to confidently deal with some of the tradeoffs in the design process between operating and capital costs.

Iogen is clearly one of the more credible organizations operating in the lignocellulosics-to-ethanol field. Unfortunately for BC, Iogen's technology is not currently suited to the softwood residues that are the primary feedstock of interest in the Province. Iogen has a sound business plan that will likely result in commercial success so it is unlikely that they would be interested in softwoods in the next several years. The development of a pretreatment process that produced both cellulose and hemi-cellulose that could be enzymatically hydrolyzed economically would allow the remainder of the Iogen process to be commercialized in BC. A high value market for lignin produced from softwoods could also make the process more economic in BC.

BC International Corporation

BC International Corporation (BCI) was formed in 1992; it was originally BIONOL Corp. and developed a paper mill sludge to ethanol project in New York state. One of the participants in the project was BioEnergy International, which held the rights to technology developed by the University of Florida for the conversion of five as well as six carbon sugars to ethanol at high yields. BioEnergy went bankrupt in 1995 before any plants were built using the technology. BCI acquired the exclusive license rights to the technology from the courts. It is headquartered in Dedham, Massachusetts and is a privately held company.

BioEnergy spent five years working with the University developing the technology. At one time there were thirty researchers and engineers doing development work on the process. The company built a 100-pound per hour hydrolyzer capable of producing 10 pounds per hour of fermentable sugars. The unit was operated on corn stover, bagasse, and hardwood chips. The recovered sugars were fermented in a variety of pilot scale units. BioEnergy and its parent Quadrex Corporation developed very ambitious plans and a number of new plants and sub-licenses were announced for various parts of the world. These have all expired and BCI claims to be the exclusive license holder.

BCI has alliances with two companies, ICF Kaiser and TIC, for the design and construction of the first commercial plant. These engineering, procurement, and construction companies will also construct and guarantee the next nine plants. In addition they have a diverse team of experts and consultants supporting them. This group includes Dr. Lonnie Ingram, the inventor of the key organism, Dr. Ray Katzen and Rafael Katzen Associates International Inc. among others. The company is also receiving support from the United States Department of Energy for the process validation work and a commercial demonstration plant being built at Jennings, Louisiana.

Technology

The unique aspect of this company's technology is the genetically modified organism based on several organisms including e.coli, a bacterium which has the ethanol production genes of zymomonas spliced into it. This recombinant organism can now ferment both hexose and pentose sugars with over 90% efficiency claimed. It has been further modified to increase its ethanol tolerance, maintain its introduced traits, extend its pH and temperature tolerance and expand its substrate range, including the ability to ferment sugar oligomers (short chains of sugars). The process is thus ideally suited to handle agricultural feedstocks and hardwoods that produce both sugars during hydrolysis.

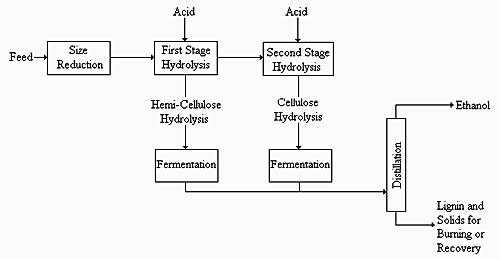

The remainder of the BCI process is based on established technology for the basic steps of feedstock handling, hydrolysis and product recovery. The company uses a two stage dilute acid hydrolysis process for the preparation of the sugar streams from its preferred feedstocks. The hydrolysis is done in two stages, the first releasing the hemi-cellulose and the second the cellulose. Both of these stages involve elevated temperatures and pressures and dilute sulfuric acid to keep the reaction times short. There are two separate fermentations although both use the same organism. See Figure 2.

Figure 2: BC International Process.

The two stage dilute acid process has been known for many years. During the Second World War there was an operating plant in Oregon using this basic technology. In the 1950's the Tennessee Valley Authority (TVA) conducted pilot-plant studies in co-operation with the USDA. In 1981 TVA renewed its wood to ethanol research program, this process was one that TVA concentrated on for several years because it was an improvement over past commercial practices and because of TVA's experience with it. The two-stage approach was used to maximize the production of sugars from both the hemi-cellulose and cellulose fractions without significant degradation of the pentose sugars. TVA's work on the process ceased in the late 1980's. Problems that were not overcome included fermenting the pentose sugars and high capital costs relative to grain based plants.

Over the past two years BCI has undertaken a validation testing program at facilities belonging to the TVA. BCI have demonstrated feedstock hydrolysis at a 1 ton per day rate. They have done fermentations of up to 2500 gallons and confirmed material and energy balances. All of this data will be used in the design, modification, and conversion of an inactive grain based ethanol plant in Jennings, Louisiana. This plant now is owned by BCI. The company held a ground breaking ceremony for the new cellulose front end for the facility on October 20,1998.

BCI had planned to take a phased approach to the operations at Jennings to prove the commercial viability of its technology and process. The approach was designed to minimize risk, integrate with known process steps and maximize the reward/risk ratio. Phase one involved the start up of the Jennings facility at a rate of 10 million gallons per year (38 million litres) on mostly pentose sugars from hemi-cellulose from sugar cane bagasse and rice hulls. This stage was designed to prove that the organism works, demonstrate the integrated concept, provide income, and establish a new business. The second phase involved expanding to the full capacity of the plant (20 million gallons) by utilizing the cellulose present in the feed. It would integrate cellulose hydrolysis and six carbon sugar fermentation. It would also provide a total conversion process and enhance plant profitability. Complications arising from trying to separate the two phases have resulted in a revised plan to combine both phases.

The plant will undergo expansion and modification over the next 18 months. The front-end hydrolysis equipment will be modified used furfural production equipment purchased by BCI. The company is also installing pilot facilities at Jennings to aid in the design and process improvement work that will take place in the full-scale plant. Full-scale production is planned for early in 2000.

There has been some concern expressed about the use of a bacterium such as e.coli in an industrial application. Other forms of the bacteria are the cause of serious illnesses that affect humans. The Animal and Plant Inspection Services of the USDA has made a determination that the recombinant organism is not an animal or plant pest and therefore does not require a permit for interstate commerce. There may be State or local permits that are required but those will have to be addressed on a case by case basis. The e.coli cell mass generated in the fermentation process is used as a boiler fuel to provide energy to the plant.

Like most processes for lignocellulosics, the energy consumption is higher than a grain fed plant. A more difficult feedstock, combined with more dilute solutions, requires more energy to pretreat the feed, recover the products and treat the waste streams. Depending on the feedstock a large portion of this energy can be supplied by the lignin and other waste biomass such as bark.

The weak acid hydrolysis used by BCI can be used for softwoods but excellent process control must be used to prevent the hemi-cellulose from being degraded to furfural or tars before the cellulose is completely hydrolyzed. This degradation would result in a lower yield and increased waste streams for the plant to handle. These problems would also impact on the production economics and cause ethanol production costs to increase. Proper scale up of the process is very important to maintain good control over the process.

BCI has started to focus on softwoods because of the interest generated by the Quincy Library Group in northern California. BCI's work is at the very earliest stages and is primarily looking just at the composition of the potential feedstocks. They have not yet investigated solutions to the problems raised by softwoods.

The BCI process also generates lignin with volumes dependent on the feedstock. The present plans are to use lignin to generate process heat for the plant. Eventually BCI would like to find higher value uses for this material.

There are significant volumes of waste generated by the process. In addition to the lignin there are other extractables from the feedstock and cell biomass from the fermentation stage. There will be a waste treatment plant as part of the process. Solids including lignin will be recovered from the treatment plant for their heat content and BOD and COD will have to be reduced prior to discharge.

Business Plan

BCI does have a long term business strategy in place. The keystones are to use a phased technology approach to develop the process step by step and to minimize risk by taking advantage of the low cost equipment available at Jennings. By concentrating on the less difficult steps and solving them the company will add credibility and reduce risk. The approach has worked very well for other companies in the technology development field. The second key strategy is to develop an operations platform by refining the technology and optimizing the processes involved. This development of the technology is important since low cost capital equipment will not be available for every new plant.

With a sound operations foundation in place, BCI plans to expand beyond the Jennings facility. The company is open both to developing new facilities that they own and to licensing the technology. The advantages of being owner operators are that it is easier to gain market acceptance and increase revenues with greater control over your own destiny. The advantage of licensing technology is that it broadens the technology use without large capital exposure. It is usually difficult to sell technology to others if you have not been able to commercialize it yourself. In the longer term BCI would like to apply the technology to other value added products such as chemicals or food additives.

Like Iogen, BCI has the next steps in the development of the technology underway with the commercial plant at Jennings. This is a very large step up in scale and is not without its risks. If successful it will make this plant the world leader in the conversion of lignocellulosic material to ethanol. The availability of the low cost Jennings facility in an area with abundant agricultural residues was a unique opportunity for the company. BCI is looking at other opportunities to apply the technology but will have to be careful not to overextend itself.

BCI has signed a letter of intent with the City of Gridley, California to develop a 20 million-gallon facility using rice straw and other material as feedstock for a biomass to ethanol plant.

Economics

BCI is not willing to make public any information on operating or capital costs at this time. An accurate capital cost estimate for the Jennings facility is now being developed. This will be a refinement of the +/- 25% estimates previously done. BCI has stated that they believe that with very large plants they will be able to get ethanol production costs down to 20 to 25 cents per litre (Canadian) although it is not clear if feedstock costs are included or if the cost estimates included revenues for the expected co-products.

BCI's advantage is clearly the ability to ferment pentose and hexose sugars. That is particularly important for agricultural and hardwood residues but also has some impact on softwoods. The two-stage hydrolysis is a complicated process with many more processing steps than a conventional grain plant. This will result in higher capital costs and higher operating costs. Either very low or negative feedstock costs or significant co-product credits will be required to overcome the capital cost disadvantage.

BCI has indicated a willingness to work with a team from British Columbia to devise an approach to identify, evaluate, and develop technology that would be beneficial to all those involved. This could include a more effective hydrolysis process for all materials including softwoods.

Arkenol, Inc.

Arkenol is a privately held company with headquarters in Southern California. It is an affiliate of Ark Energy, a developer of independent power projects. Arkenol was formed in 1992, initially because ethanol plants with their high steam demand would make good host sites for electricity co-generation facilities. The company's mission has since expanded beyond the thermal host strategy to becoming a world leader in the production and sale of bio-chemicals and fuels.

Arkenol and Ark have a full staff of professionals with expertise in project development, management and technical specialists. The company claims that it is in the final development stages for a 48 million litre per year biorefinery processing rice straw to be located in Sacramento, California. There are projects in planning stages at a number of other sites in the US and various International locations. The company has formed a joint venture company with LL Knickerbocker to develop plants in China. This company is called Arkenol Asia, Inc. A Chinese corporation, Central Resource Northern Development Corp., has recently signed a letter of intent to invest $10 million (US) in this company for a 5% equity position. Ark Energy has developed or acquired 610 megawatts of natural gas fired cogeneration facilities. These facilities have a reported value of $850 million (US). Arkenol claims a number of strategic relationships with equipment vendors, engineering and construction firms and regional industry leaders.

Technology

The company has developed proprietary concentrated acid hydrolysis technology. This basic process has been known for over 100 years and was practiced by the Germans and Russians in the early part of this century to produce ethanol and chemicals. By the 1950's these plants were not competitive with low cost ethanol produced by petrochemical processes. Through the 1970's and 1980's with the rapid increase in petroleum prices there was renewed interest in the technology and further development work was carried out by a number of organizations including the Tennessee Valley Authority and Mississippi State University.

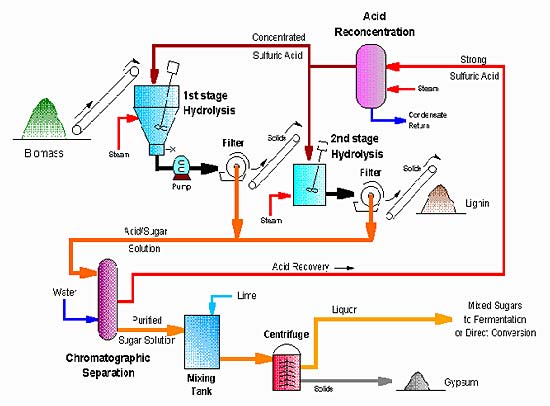

The advantages of the concentrated acid process are that the reaction is fast and is carried out at lower temperatures and pressures than those using dilute acid. These advantages result in less unwanted degradation products. The traditional disadvantages have been high costs of construction due to the concentrated acid and multiple process steps, and higher operating costs due to acid losses and high waste levels. The Arkenol process is shown in Figure 3.

Figure 3: Arkenol Process

Arkenol have further developed the technology to reduce the costs. They have added new process control methods and found new modern materials for construction to lower capital costs. The company claims the following proprietary improvements:

- Efficient acid recovery and reconcentration;

- High sugar concentration at high purity;

- The ability to ferment hexose and pentose sugars with conventional microbes;

- The ability to handle silica in the feedstock (ash);

- All by-products are usable and marketable.

The company has received US and International patents covering a variety of aspects of the process including:

- Producing the sugars using concentrated acid of cellulosic and hemi-cellulosic materials;

- The separation of acids and sugars;

- The fermentation of sugars produced from strong acid hydrolysis;

- A method of removing silica.

The company has other patents pending including one that covers the separation of acids and sugars using Ion Exchange. Arkenol claims additional intellectual property not yet patented as well as some technology licensed from others.

In addition to its laboratory work with the process, Arkenol has constructed and operated a one ton per day pilot facility in Southern California. The plant is composed of commercially available equipment. It is not fully integrated and thus the process has not been demonstrated on a continuous basis at this level. Arkenol has also worked with and been funded by the US DOE on various aspects of the technology.

Arkenol has a very comprehensive list of documentation available for a project. This includes commercial documentation, general process drawings, general documentation, and preliminary engineering support for all systems but does not include the typical site-specific drawings and documents usually supplied by the EPC contractor. The level of documentation is typical of any commercial process. The preliminary engineering support documentation covers the following process stages:

Biorefinery Plant Site General Arrangement

Process Notes

Biomass Preparation *

Primary Hydrolysis

Secondary Hydrolysis *

Acid/Sugar Separation & Acid Reconcentration Systems *

Lime Slaker & Lime Distribution *

Sugar Neutralization & Gypsum Filtration *

Nutrients Preparation & pH Adjustment *

Product Process Drawings (eg. ethanol)

- Fermentation

- Beer Centrifugation

- Yeast Preparation

- Distillation

- CO2 Recovery System

-

Chemical Receiving

Fresh & Process Water System

Cooling Water

Chilled Water System *

Steam Distribution System

Condensate Return

Plant & Instrument Air System

Waste Water Neutralization System

Firewater System

Clean-In-Place System

The documentation is more advanced than that any of the other process developers. This is probably due to Ark Energy's experience in project management. The drawings marked with an asterisk represent additional process steps over those found in grain ethanol plant.

Arkenol's improvements to the technology are designed to lower production costs, improve yield and make the process more viable. The process proposed by Arkenol is also complete as it addresses all aspects of the conversion of lignocellulosics to ethanol including the fermentation of pentose sugars with yeast adapted by Arkenol. This yeast requires relatively long fermentation times and still does not completely convert the pentose sugars to ethanol. There is a recycle of unfermented pentose sugars from the still bottoms back to the fermenter. Arkenol has recently tested and licensed a zymomonas strain from NREL that reduces fermentation time substantially.

The major weakness is the lack of integrated operation of the pilot unit to gather data to validate the concepts and process. The proposed scale up to a 12 million gallon unit is a 500 times increase over the existing unit as well as incorporating the continuous operation complexity that the pilot unit has not addressed. This is a more significant scale up than is normally carried out in the process industry.

The concentrated acid technology is suited to softwoods although for the Arkenol process the feedstock needs to be clean, relatively small size and have less than 10% moisture. This moisture may require drying of the feedstock which would add operating and capital cost to a project. Arkenol has been working on rice straw as the feedstock for its first commercial plant. Other plants have considered using materials such as municipal solid waste. Softwoods have recently been analyzed and tested by Arkenol but have not received significant pilot plant time from Arkenol.

The Arkenol process will produce lignin and gypsum as co-products of the process. The company claims that both can be sold to a variety of markets, including lignin use as a fuel, a soil conditioner, or feedstocks for further processing. The concentrated acid processes usually produce a lignin that has less potential for upgrading due to the amount of degradation that occurs in the processing. Depending on the feedstock other products can also be produced such as silica when rice straw is used. The proposed uses of the co-products are all relatively low value and will not significantly impact the cost of producing ethanol.

The process has been designed for near zero discharge. It is not clear how water-soluble extractives would be removed from the process streams on a continual basis. Arkenol have not studied this issue.

Business Plan

Arkenol has been working for a number of years on a 12 million-gallon per year plant to process rice straw and produce ethanol and electricity. The plant is planned for Sacramento, California and while it has been fully permitted, Arkenol are now planning some changes in concept and size that require new permits. These new permits and financing are scheduled for completion in May 1999. The company has been working on the financing for the facility for several years. Arkenol expects significant (27 cents per litre Canadian) co-product credit from the silica in the rice straw. The construction and operation of this plant is key to Arkenol's long term success. The technology needs to be confirmed and demonstrated on a significant scale. This project will provide confirmation of capital and operating costs for the technology.

Arkenol has also been working to establish regional/national joint ventures to enhance market development. Typical of these would be the Arkenol Asia effort mentioned earlier and the effort with North-South Trade for Canada. Arkenol is looking for specific projects that can be developed with a strategic operating partner seeking value from the technology, such as someone dealing with a wood waste disposal problem.

Arkenol is willing to be both a plant owner-operator and a licensor of technology to others. Arkenol is also interested in the production of a wide variety of chemicals from the same basic process. Other products that are of interest include, citric acid, butanol, levulinic acid, succinic acid, isopropanol, xylitol and xanthum gum. These are lower volume higher value products compared to ethanol.

Economics

Arkenol and North South Trade have developed preliminary estimates including capital costs, operating costs and revenues for a typical project in BC that would convert 180,000 tonnes of softwood residues into 65 million litres of ethanol and related co-products. The capital cost of this project is $160 million Canadian. The capital cost is approximately five times higher than that of a similar sized grain ethanol plant. Part of the higher cost is expected because of the more complex nature of the process but also because the plant is being scaled up from a very small pilot plant and the design is conservative to allow for uncertainties. The company is offering process guarantees to purchasers and this is expensive given the lack of previous experience. These high capital costs will limit the returns available from any project and in most cases will wipeout any cost advantage that the lower softwood feedstock cost represents over grain. Arkenol think that plants built after the first one will benefit from the experience gained with the first plant and the capital costs may be reduced by 30-50%.

The operating costs for the Arkenol process are higher than for a grain plant. This is expected since the process is more energy, labour, and capital intensive. According to Arkenol operating costs, excluding feedstock and capital recovery, are about 30 cents per litre Canadian. Feedstock costing $20 per tonne would add 5 cents per litre. Co-product credits would depend on the market for lignin, carbon dioxide, gypsum, and yeast but could produce credits up to10 cents per litre. Most of the credit comes from the yeast and CO2 and markets for those products will be site dependent. If the ethanol was sold for 45 cents per litre, the 10-20 cents per litre cash flow is insufficient to service the capital costs.

In order to be viable the process requires a lower capital cost and higher values markets for the co-products.

Paszner ACOS

Dr. Laszlo Paszner of the Faculty of Forestry at UBC developed the Acid Catalyzed Organosolv Saccharification process in the early 1980's. The process is covered by a series of Canadian and international patents. Paszner's first patent was originally aimed towards producing pulp but it was found that a variation of the operating conditions would convert the lignocellulosic material to sugars and lignin.

The process was originally developed in the laboratory, processing on a batch basis with vessels up to 2 litres in size. In the 1980's Dedini, a Brazilian firm, built a 16 litre continuous flow reactor pilot plant that processed bagasse to sugars. Dr. Paszner claims that the plant operated for six months before all work was stopped due to a dispute over ownership of the patents. The patent ownership was eventually confirmed as Dr. Paszner’s. The existence of the Dedini pilot plant was confirmed by a visit to Dedini and report prepared by Corporate Support Services for Energy Mines and Resources Canada. Dedini did not allow Corporate Support Services to see the unit.

Dedini was interested in building ethanol plant equipment that would use the ACOS process. Dedini reported problems with the design and manufacture of the reactor, the filling system for the reactor, the solvent recovery system and the liquor treatment system. The ACOS process was planned for front end of the process and the Swedish Biostil system was to be used for later fermentation and distillation. Dedini did work on the pilot plant design for over two years and claimed to have spent over $1 million US before work was stopped.

Consulting groups AD Little and Wardrop Engineering in the early 1980's also studied the process. The Wardrop report was done for Canertech, a Federal government company. The Wardrop report recommended that Canertech build a hydrofluoric acid pilot plant. There were concerns about patent ownership with the ACOS process and the fact that the technology had not been independently verified. The Canertech facility was closed after several years of operation.

A study of the fermentation of ACOS hydrolyzate performed for NRCan in 1994 further developed the technology. A simulated continuous hydrolysis reactor using a flow through percolation setup produced higher sugar recovery levels than previous batch experiments had provided. The fermentability of the hydrolyzate was good for hexose sugars and various treatment methods were tried to remove fermentation inhibitors that provided even better fermentability. Dr. Paszner made a number of recommendations at the time. These included further optimization of the percolation type hydrolysis, further fermentation work, and the development of a pilot unit.

In 1994 the engineering firm Fluor Daniel performed an engineering feasibility study on a 50 tonne per day and a 350 tonne per day plants using the ACOS process. The study is not available to the public due in part to a dispute over commercial terms between Paszner and the other project proponents at the time. The study scaled up the lab results to the demonstration and commercial levels.

Dr. Paszner claims to be developing projects with investors in Alaska and Venezuela.

Technology

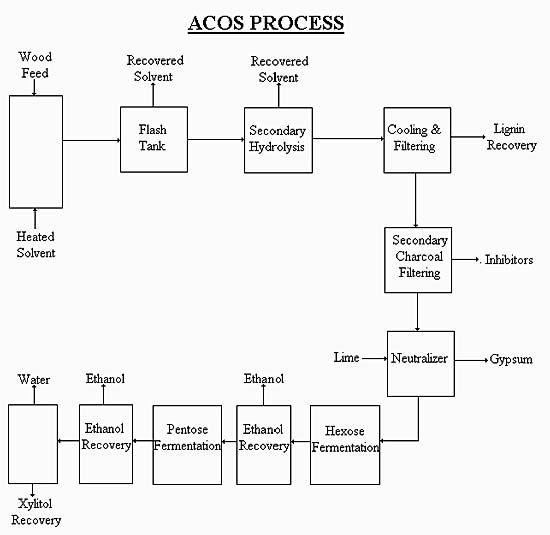

The ACOS process involves the solubilization of all components of lignocellulose with a concentrated solution of acetone with a small amount of acid. The reaction is carried out at temperatures around 200C and relatively high pressure of 40 bar. Residence times in the reactor are on the order of 0.5 hours. The feedstock needs to contain moisture and be hammer-milled. The solvent to substrate ratio is closely monitored and maintained. In a commercial plant it is proposed to use a continuous counter flow reactor. Upon leaving the reactor the solution is flashed to recover a portion of the acetone and lower the temperature. A secondary hydrolysis is performed at about 100C for 20 minutes that drives off and recovers the remainder of the acetone. The lignin precipitates and is cooled, filtered and recovered. The sugar solution is charcoal filtered and the acid neutralized prior to fermentation. A very concentrated sugar solution is claimed to be possible at this stage. The hexose sugars are fermented to ethanol. The ethanol is distilled and the stillage containing the pentose sugars is fermented to ethanol and xylitol, a very high value sugar. The xylitol sugar is crystallized and most of the remaining water is recycled back to the primary reactor. A small amount of water that may require treatment is discharged. A block diagram of the process is shown in Figure 4.

Figure 4: ACOS Process.

Solvent pulping has been practiced for the production of pulp. A demonstration plant was built and operated by Alcell in New Brunswick using ethanol as the solvent. The plant was operated for several years but eventually shut down due to combination of technical and economic factors. The lignin produced would likely be very similar to that produced by the ACOS process. Paszner claims that resin manufacturers were very interested in the Alcell product. The lignin has a low molecular weight, is very uniform, and is a very stable product with interesting properties.

The ACOS process has a number of unique aspects. It is claimed that a wide variety of feedstocks including hardwoods, softwoods, agricultural residues, and grain can be processed with the same conditions. The hydrolysis can process the hemi-cellulose and the cellulose at the same time without any significant degradation of the pentose sugars resulting in high yields. The process produces a concentrated sugar solution reducing recovery costs. None of the other processes studied have these advantages.

The advantages of the ACOS process are provided by both the chemical nature of the process and the physical processing scheme. Dr. Paszner acknowledges the different reaction rates for hemi-cellulose and cellulose and some of his batch experiments did not have good sugar yields. To overcome this Dr. Paszner proposes a continuous flow countercurrent reactor to allow longer reaction times for the cellulose than the hemi-cellulose. This reactor design has only been simulated in the laboratory and needs to be proven at a larger scale. The problems reported by Dedini in designing a pilot plant reactor that produced high sugar yields is an indication that the appropriate reactor design is a complex problem. In addition, Dr. Paszner claims that the organic solvent protects the sugars from significant degradation.

This single stage hydrolysis has the potential to lower capital and operating costs of the plant compared to the two stages that are required for all of the other processes. There is only one solids filtering step unlike the acid processes. The reaction times are short unlike the enzymatic process; again this helps to lower capital costs.

The product recovery steps involve basically known technology. The fermentability work was successful although it did involve the carbon filtration steps that are not normally practiced in the ethanol industry. There may be alternative ways to improve the sugar to ethanol conversion rates without the additional process steps.

The ACOS process has been known for a number of years but other than the Dedini pilot plant, to which Dr. Paszner has never had access, the process is still essentially at the lab stage. It has not been demonstrated on a continual basis nor have any of the recovery steps been demonstrated with commercial type equipment. There have been very few successful processes that have been able to move directly from the lab to commercial reality. The risks are usually higher than companies wish to accept.

Business Plan

There is not a Business Plan in the normal sense for the development of the process. Dr. Paszner is working with groups for plants in Alaska and Venezuela but it has not been possible to verify the resources of these groups. The Venezuelan group is apparently trying to secure long term timber rights to raise financing for the project.

Normally, the next step in a process development would be to build and operate a pilot plant. This has been proposed by a number of groups that have reviewed the process.

Economics

The feasibility study mentioned earlier developed capital costs for a variety of scenarios. A plant processing 350 tonnes per day of softwoods producing lignin, xylitol and 42 million litres of ethanol a year had a capital cost of $145 million dollars. This is quite high, a hardwood plant producing less lignin had a cost of $110 million. Costs are likely to be conservative given the nature of the scale up from the lab to full scale and the production and recovery of xylitol. One of the primary reasons for doing pilot plants and demonstration units is to better understand the process so that costs can be minimized for a full scale plant. As mentioned earlier the process is simpler than the acid processes and that should equate to a lower capital cost and lower operating costs.

The operating economics are skewed by the production of xylitol. A market value of $3000 per tonne has been used in the feasibility study and 45% of the operating costs are attributed to this product. The lignin is projected to sell at $250 per tonne with 20% of the costs attributed to lignin. Ethanol equates to 20 cents per litre under this scenario. The projects are very profitable with these assumptions. The economics should be re-evaluated without xylitol but with pentose fermentation to ethanol. Capital costs will lower but so will revenues. The project would be simpler and pose less technical risk.

Gasification-Fermentation Routes

The ethanol production system reviewed here is unique because it is a combination of two processes offered by two companies that has been put together for the report as they offer an interesting alternative to the other processes reviewed. The two systems are a wood gasification system offered by Brightstar Synfuels Company of Texas and a biological syngas to ethanol process developed by Bioengineering Resources, Inc. (BRI) of Arkansas. Several companies, who would be essentially systems integrators, are discussing the combination of the two technologies.

Gasification

There has been almost continual interest in the gasification of wood residues (a thermochemical conversion route) since the first oil shock of the early 1970's. The technology is old and relatively well understood. It was practiced on a large scale during the Second World War. The availability of abundant and low cost natural gas following the war made the technology uneconomic and unattractive. The same basic technology is used on other feedstocks such as coal and a variety of liquid hydrocarbons in a large number of chemical processes. The production of methanol from natural gas uses similar technology. Small-scale reformers are being proposed for the production of hydrogen for fuel cell powered vehicles. The use of wood as the feed for these systems does introduce a number of complications because of the non-uniformity of the feed in terms of composition, size, and moisture content and because of characteristics such as the ash content.

There are several biomass gasification systems being demonstrated today. In Hawaii a system operating on bagasse and a second system operating on wood in Vermont have received significant support from the US DOE in recent years. The Biomass Energy Research association in the US recommended to the DOE budget appropriation committee that a further $27 million US be spent on these two projects in fiscal 1999.

The Hawaii system has operated for about 500 hours but is not currently operating due to a lack of funds imposed by DOE budget constraints. It was designed by the Institute of Gas Technology (IGT) and is a pressurized air/oxygen system that can process 50 tons per day of bagasse. It produces a low (on air) or medium (on oxygen) Btu gas. There are a number of partners involved including Westinghouse who is trying to build on their experience with coal gasification. The system has experienced problems with the feed system.

The Vermont plant is a different design and involves indirect gasification to produce a medium Btu gas. Battelle Columbus Laboratories designed the gasifier. Development was initiated in 1977 leading to a process research unit being built and operated in the mid 1980's. Construction of the unit was expected to be complete late in 1997. The unit is not yet in full operation. This unit is not expected to require gas clean up prior to combustion in a gas turbine.

There continues to be considerable interest in gasifiers in Europe. The final meeting of the European Biomass Gasification Network was held in Stuttgart in April 1997. The meeting brought together all of the European experts as well as North Americans. The meeting also formed the third joint EC-Canada thermochemical contractors meeting. Over 50 presentations were given with 24 of them on various aspects of gasification. The consensus of the meeting was that significant progress had been made over the previous three years but that the technology was not yet truly economic or is the technology proven. There are still technical issues with reactor design and gas cleaning.

A private company Brightstar Synfuels Co. has a prototype wood gasification demonstration facility in Louisiana. The system incorporates a number of leading coal gasification technologies. The tubular nature of the system allows very high length to diameter ratios that give the opportunity for the various chemical reactions to proceed to completion. One of the benefits is a gas that is very low in tar and oil. The system produces a medium BTU gas through a non-catalytic externally heated steam reforming system. The unit is a 0.75-tons/hour feed with the concept of multiple modules being used on larger plants. The feed can have a moisture content up to 40% but must be sized so that it can be moved pneumatically. The demonstration facility is shown in Figure 5.

Figure 5: Prototype Brightstar Gasifier.

The gas produced typically has the following composition:

Hydrogen

Nitrogen

Methane

Carbon monoxide

Carbon dioxide

C2+

The gas composition can be altered slightly through changing process conditions but without involving a catalyst it is difficult to produce more hydrogen and carbon monoxide and less methane. The carbon dioxide is a function of the overall system efficiency. The use of a catalyst is not practical without gas cleaning to reduce particulates and the heavy hydrocarbons to prevent fouling of the catalyst.

Brightstar does have a system to clean the gas to remove the ash and other particulates that has been developed for coal gasification systems. The cleaned gas has been cooled and would have to be reheated in a catalytic reforming system to improve the gas composition. The methane can be used to supply the energy for the distillation process after the carbon monoxide and hydrogen have been fermented.

The prototype was completed in 1996 and has operated weekly since then. Some of the operating runs have been for seven days. The company now has three commercial units nearing completion. These units are smaller with a feed capacity of 3000 pounds per hour. One unit will be going to Australia with the other two installed in the US. The Australia plant is designed to be coupled to a one-megawatt engine generator system. The gasifiers are skid mounted and can be transported by truck. The concept for larger plants is to have multiple small units coupled together.

Economics

Brightstar considers the capital costs of their systems to be confidential information at this time. They do indicate that in system with 3-4 modules they would be willing to own, operate and sell gas back to the mill for $4 per million BTU (Can). Presumably feedstock costs would be extra. This cost is competitive with natural gas in many areas of the United States but is higher than costs in British Columbia.

Fermentation

Bioengineering Resources Inc. has developed a novel fermentation process that can convert carbon monoxide and hydrogen to ethanol. The process was originally developed to deal with waste gases from the refining industry, the ethanol produced via this method would not be renewable but if the syngas were produced from biomass then the ethanol would come from renewable sources. BRI began their work in 1994 with funding from the US DOE. DOE funding was removed due to budget cuts in 1997.

BRI has been active doing contract research for over ten years. They have 35-40 professionals on staff working on a variety of projects all involving biological processes. In addition to their work on ethanol production from syngas they have developed a similar process for the manufacture of acetic acid. That technology has been piloted and licensed to a major international chemical producer who is planning on scaling the process up and commercializing the technology. In these cases the syngas feed will be derived from reformed natural gas. This company also has a license for the production of ethanol from reformed natural gas.

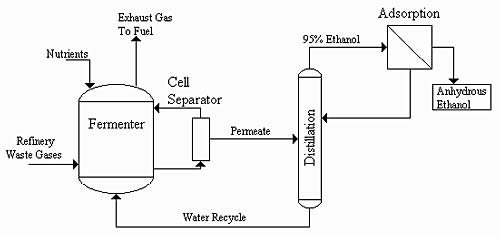

Technology

The technology has been developed in the laboratory and has been operated continuously for over a year. BRI has also operated their acetic acid pilot plant as ethanol pilot plant for several months. This unit has a reactor about two feet in diameter. A detailed process design has been prepared for the construction of a prototype unit which would produce 2.63 lb./hour of ethanol (12,000 litres/year). This is the same size as the acetic acid unit. This unit was designed to handle a syngas with approximately 20% each of carbon monoxide and hydrogen. The organism is reported to be able to tolerate contaminants such as sulfur, methane and nitrogen. The basic process flow is shown in Figure 6.

Figure 6: Bioengineering Resources Inc. Process.

The fermentation vessel operates at slightly above ambient temperatures (37C) but at moderate pressure (40psi) so that reaction rates are increased. The organism belongs to the clostridium family. BRI claims that the organism is stable and able to recover after a process upset. Ethanol is toxic to the culture so ethanol concentrations are kept below 3% v/v in the reactor. The organism consumes carbon monoxide, carbon dioxide, and hydrogen to produce ethanol and acetic acid. The acetic acid production is minimized by the recycle of distillation bottoms containing some acid back to the fermenter. BRI reports that the pathways are:

6CO + 3H2O > C2H5OH + 4CO2 and

6H2 + 2CO2 > C2H5OH + 3H2O

The reactions would indicate that carbon dioxide is also produced along with the ethanol. BRI claims that they have overcome previous problems with the recycling of water back to the fermenter and that the recycle is no longer toxic to the culture.

The fermenter will produce an excess of cell mass over time that will have to go either to a treatment plant or possibly, after de-watering, back to the gasifier. There may also be a small water stream that must be discharged to maintain the water balance.

One of the distinct advantages of this route would be that bark could be processed as well as softwood sawdust and shavings. There would be no co-products involved other than the excess energy generated by the system. This energy would be in the form of methane and could be used in a variety of applications including a gas turbine cogeneration system.

BRI are looking for a partner to build a semi-commercial demonstration unit. The reactor would be 20 feet in diameter and would be capable of producing 12-15 million litres a year of ethanol. This size was chosen because it is a ten times scale up of the largest reactor run to date. BRI are not experts in gasification but have discussed the concept with Brightstar Syngas and think that the pressurized gasifier offered by Brightstar is a good fit for their technology. The Brightstar system does produce a significant amount of methane that would pass through the reactor and be available to provide the external energy that the gasifier requires. Preliminary calculations would indicate that ethanol yields of 375-400 litres per tonne of wood could result.

This demonstration facility could also be built at a site that had syngas available. This way one new system could be demonstrated rather than trying to commercialize two new systems at the same time.

Economics

A capital cost estimate was prepared for a 113 million litre per year plant during the DOE funded work on the project. There have been improvements to the process since then. The total capital cost was estimated at $25 million (Canadian) without any capital for the syngas generation. Operating costs were estimated at seven cents per litre (Canadian) without feedstock cost and capital recovery. Both capital costs and operating costs are very attractive but they are being extrapolated from laboratory data. The gasification costs from the Brightstar system would add 13-19 cents per litre to the operating costs assuming that wood cost up to $20 per tonne. The overall system economics are encouraging but must be viewed as preliminary given the early stage of development.

Technology Summary

It is difficult to compare the leading technologies that have been evaluated here since they are all at different stages of development and thus the level of certainty surrounding each process is different. Table 9 is a qualitative comparison of the five technologies reviewed in the report with the established grain to ethanol technology. The costs for the grain plant do not include interest, taxes, depreciation or profit, as these are project dependent.

Table 6: Comparison of Process Economics

x

Grain

Iogen

BC International

Arkenol

ACOS

Bioengineering Resources

Development Status

Proven and Commercial

Building Demonstration

Building Commercial

Laboratory

Laboratory

Laboratory/Pilot/Demo

Capital cost

$0.5/l

Higher

Higher

Much Higher

Higher

Similar

Feedstock

Grain

Agricultural residues

Bagasse

Softwood

Softwood

Softwood and Bark

Feedstock cost

$0.3/l

Lower

Lower

Lower

Lower

Much Lower

Co-product value

$0.15/l

Lower

Lower

Lower

Higher?

Lower?

Operating Costs

Energy

$0.05/l

Higher

Higher

Higher

Same?

Same?

Labour

$0.045/l

Higher

Higher

Higher

Higher

Same?

Chemicals

$0.03/l

Higher

Higher

Higher

Higher

Lower?

Maintenance

$0.025/l

Higher

Higher

Higher

Higher

Higher?

Overhead

$0.04/l

Higher

Higher

Higher

Higher

Same?

Total

$0.34/l

Higher Today

Higher Today

Higher Today

Lower?

Lower?

It can be seen that none of the technologies reviewed are at the same development stage as the proven grain to ethanol technology. The new technologies can not be considered to be commercial today. All of the technologies have substantial room for further development that has the potential to make them competitive in the future. The potential for British Columbia applications is summarized below.

- Iogen. Improvements in enzyme productivity and effectiveness will lower capital costs and operating costs. The demonstration plant being built will help to further define the process. Even more work is required for softwood feedstock, as the higher lignin levels require much higher enzyme use and thus have poorer economics. Lignin is relatively uncondensed and may have a higher value than fuel. Lignin potential requires further work. Pentose sugar fermentation is still to be demonstrated. Clearly a leading technology.

- BC International. Pentose sugar fermentation capability is their strength. Little work has been done to date on softwoods. Two-stage dilute acid hydrolysis is capital and operating cost intensive compared to grain hydrolysis. Unique low capital cost commercial demonstration project underway. Lignin may not be very reactive. Much more work is required on lignin. Also a leading technology.

- Arkenol. Very high capital cost at this time. Cost may come down after the first plant is built and a better understanding of the process is gained. Lignin is not very reactive, it will be difficult to get a high value for it.

- ACOS. Still only at the laboratory stage. Proposed design to produce xylitol and a high value lignin add complexity and cost. The single stage hydrolysis and potentially high value lignin make the process potentially the most cost effective. Question whether the single stage hydrolysis can be effective without degrading the pentose sugars. Could be a very effective pretreatment for softwoods or one of the other processes.

- Bioengineering Resources. Neither the gasification or fermentation stages can be considered proven. Needs a partner to take the combined process to the next stage. Requires detailed engineering to be done on the integration of the two processes. Has the very large advantage of being able to process bark.

Back to Biofuels Library

Biofuels

Biofuels Library

Biofuels supplies and suppliers

Biodiesel

Make your own biodiesel

Mike Pelly's recipe

Two-stage biodiesel process

FOOLPROOF biodiesel process

Biodiesel processors

Biodiesel in Hong Kong

Nitrogen Oxide emissions

Glycerine

Biodiesel resources on the Web

Do diesels have a future?

Vegetable oil yields and characteristics

Washing

Biodiesel and your vehicle

Food or fuel?

Straight vegetable oil as diesel fuel

Ethanol

Ethanol resources on the Web

Is ethanol energy-efficient?